Abstract: The US Department of Defense (DoD) must transition to a space-based commercial partnership for tactical national defense sooner rather than later, or we'll be left behind in terms of global defense posture. Commercial space cost differentials are changing the calculus of defense policy even faster than the Federal Aviation Administration (FAA) can mismanage domestic aviation policy!

The feature image up above, and the name of this post are intentionally convoluted. My reference to Star Wars in the title isn't a direct reference to Obi-Wan and Anakin and Luke, but rather, to the 1980s Defense policy that played a small role in bankrupting the Soviet Union.

The reason for the particular image of Obi-Wan "seizing the high ground" as he famously did in his first duel with Darth Vader, was that of how if we are intelligent, the US Air Force (USAF) will go from being the dominant partner of the Department of the Air Force (DAF), to a supporting partner to a dominant Space Force (USSF). And the reason is the exact opposite of our policies in the 1980s. It's based on realizing if we don't transition to a commercially partnered DoD, we'll fall like the Soviets did.

Two senior enlisted joint terminal attack controllers (JTACs) - ground pounders who traditionally "have the low ground" in the USAF (and that's okay; Obi-Wan did just fine from the low ground against General Grevious and Darth Maul) were having an amazing dinner and after discussing what really mattered: raising kids and making tri-tip steaks with smokers and sous vides - we ended up talking shop. Inevitably, we were discussing how the inability by the USAF to embrace lower cost warfare was going to cost us massively in the future. My theory was simple:

- Building another Cold War Air Force for the Western Pacific akin to what we built for the Fulda Gap in the 1980s is not smart.

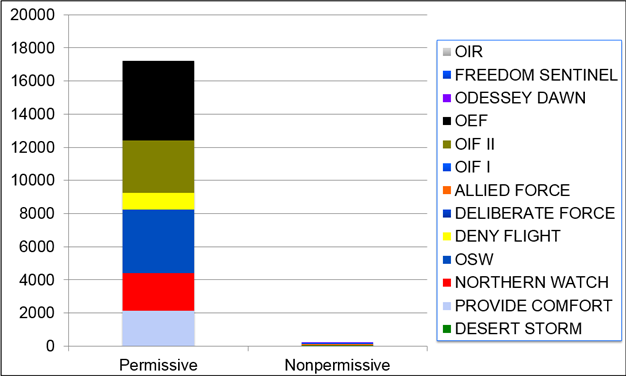

- There will be capacity problems in the long term when things like Bush Wars in West Africa or regional conflicts between Israel and Iran inevitably pop off (oooh, quick, look over there, it's a wild Niger!)[1]

- We've mortgaged the Key West Agreement by doing admittedly less optimal* close air support (CAS)[2] with a $42,000 cost per flight hour (CPFH)[3] bill before it's moved to the end of a 10,000 mile logistics chain.

* if you think the F-35 is better at CAS (or personnel recovery support) than the hawg, I've got oceanfront property in North Dakota for you...

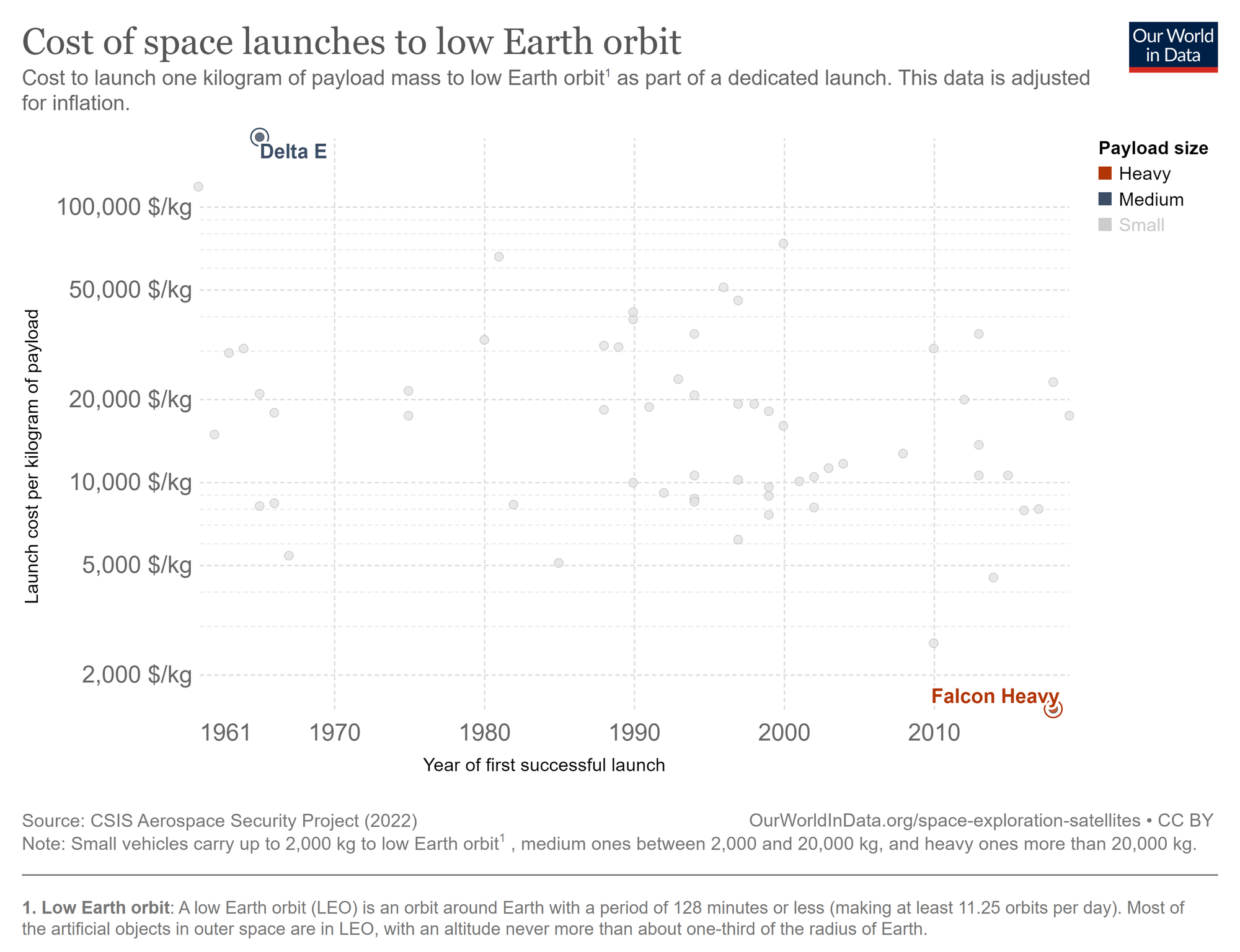

And I stand by that, and I know I'm right. I thought I was being smart and making good points and then this guy comes over the top (LITERALLY) and brings up the cost metrics in how cheap commercial space companies have made slinging a kilo of goods into orbit,[4] and how much that changes the calculus.

I couldn't have been more excited, even if the implication was that I was too small minded and thinking entirely too narrowly. That excites me; I don't have any sacred cows.

So I started doing some homework,[5] and it supports my extension of the Fractal Airpower (© 2023, Brad Dewees and Dave Blair) thesis and the role of commercial partnerships, but it's so much better in the grand scheme of things.

The thesis question grows to have two parts:

- At what point is the manned fighter/bomber vs. anti-access/area denial (A2/AD) value proposition lost at the strategic scale in the context of both operational value and in the context of gross domestic product (GDP) value relevance?

- At what point does commercial impact of space launch costs drive development of strategic *and tactical* development of tactics, techniques and procedures (TTP)?

I would argue the answer to both questions is: "it already happened a few years ago but we're waiting to lose a war before we adjust."

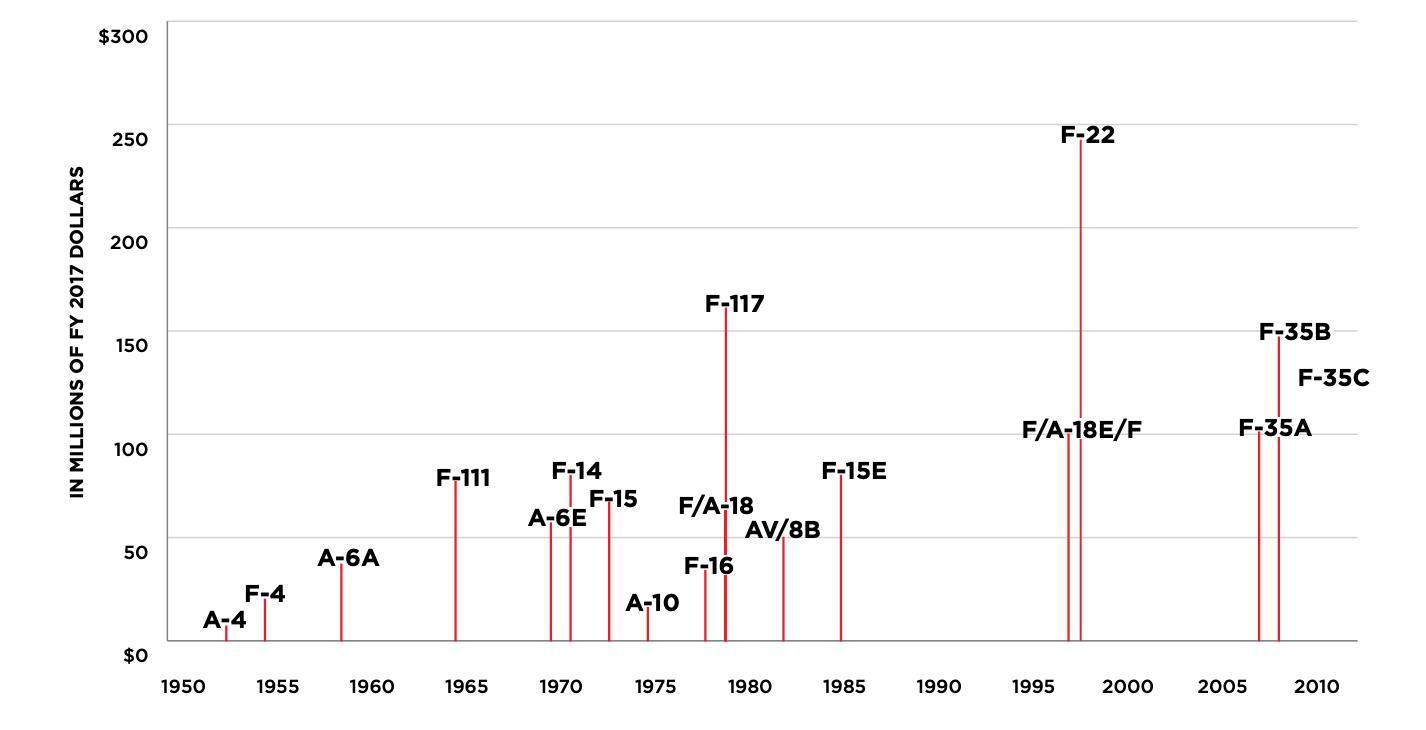

For the former, the escalation in costs for research and development then care and feeding of manned fighters for contested and degraded operations (CDO) is already prohibitively expensive, and while the technologies required to stay ahead of an A2/AD threat continue to push the boundaries of development, the costs to stay ahead are much lower.

As an example, almost every USAF weapons instructor course (WIC) graduate reading this can probably think of innovative ways to defeat various A2/AD threats ranging from the ZSU-23-4 to the S-400, but the level of difficulty and complexity to do so has scaled the costs in aircraft requirements much more rapidly than the cost of the A2/AD threat itself. For an F-35 to operate closer in to an S-400 than an A-10C is capable of is vastly more expensive than the difference in cost for finding its radar cross section (RCS) between the systems that see the A-10 at tactically effective range vs. see the F-35 at tactically effective range. Conclusion to point #1: The strategic investment engagement advantage is firmly in the hands of A2/AD threat developers. The opportunity cost to create air dominance scales higher faster than denying it does. The Fighter Mafia is going to continue to try to solve problems with platforms. Manned platforms. Poorly designed platforms with mismanaged acquisitions. Platforms procured using the joint capability integration and development system (JCIDS) and the planning, programming, budgeting and execution (PPBE) models as defined in the 5000+ pages of regulations and policy in things like the Defense supplement for the Federal Acquisition Regulation (DFAR) and associated policy guidance. Acquisition policies so complex and convoluted that it requires an entire dedicated University to teach government employees how to operate within in. They will inevitably be over budget and under-perform, much like the F-35 continues to be wildly over budget. There is however one truly innovative thing about the F-35: how many Congressional districts it has parts made in.

Finding actual research and development (R&D) numbers for systems like the S-400 is difficult; the manufacturing plant costs are even shared with other missiles, but given the domestic procurement costs for the S-400, when adjusted for inflation, it's still less than $2m to field a system and fire a single missile at a target ($214m for a fielded system that includes 112 missiles). A target that in the case of the F-35A is $100m. Firing ten missiles is still a 5:1 cost benefit ratio benefitting the A2/AD system.

Unfortunately, as platforms designed with massive overhead and logistics burdens mire the Air Force into a situation where realistic deployments and uses as directed by Congress result in unsustainable operations costs, the paradigm between manned platforms operating in A2/AD environments and the costs to deny the US DoD that freedom to operate will continue to grow in favor of the enemy.

For the latter thesis question, this is an emerging commercial market - space launches - and serving that market with a wider array of international partners will lower costs even more. Assuming that costs will level off as result of both regulatory capture and cost equilibrium, neither has occurred yet that anyone knows of.

For organizations like the USSF, leaning into the growth of the commercial sector has a lot of future growth opportunities with very little costs. As an example, with an extension of true zero trust architecture (ZTA), things could be so much better for communications reliability. Right now, this seems extremely unlikely given the arcane restrictions by the National Security Agency (NSA). But the tactically risky reliance on communications and surveillance satellites as procured by the USSF, the National Reconnaissance Office (NRO) or others is de-risked by being transitioned to commercial assets, not because the commercial assets are more secure (arguably they are, but that's irrelevant), but because they are vastly more widespread. Taking down the six Milstar satellites may be difficult, but is much less so (and has far more total payoff, again, relative to opportunity cost) than the cost to take down 4,487 Starlink satellites.[6]

It's already more effective from a cost perspective to secure data using post quantum cryptography (PQC) capable algorithms to secure ZTAs across "dirty networks." The move away from Type-1 security that is actually more difficult to implement both from a logistics perspective and from a security perspective to ZTAs can't come quickly enough, but the added benefit of making data transmission seamless across ubiquitous networks puts networks like Starlink in play from a data security perspective.

And that's useful as the enemy will likely use Starlink for their own purposes in ways we can't easily intercept or detect at the tactical edge (the ability to process the data using other methodologies may actually benefit from it running across networks like Starlink), but that also means we won't be able to deny/destroy it during operations. Thus, we'd benefit greatly from leaning into it and taking advantage of it.

The NRO itself has leaned into this. Companies like Maxar and Hawkeye 360 have earned contracts recently for surveillance data,[7] and the growth of the market is expected to further balloon between now and 2030.[8] Some of this lean-in is reactionary; existing US policies have actually forced higher resolution innovation offshore due to domestic restrictions.[9]

Even as the costs for communications and surveillance tumble due to growth in commercial sector market service, the growth in the total commercial sector of space launch is the crux of the argument. At some point even tactical problems like CAS for a quick reaction force (QRF) become more cost effective to do with launches to space of pre-positioned fire support assets. At $1500/kg, that time isn't yet, but at the rate the market has caused costs to tumble, the time is approaching rapidly.

If the US wants to be dominant, it needs the high ground. That won't be found in a cost effective manner with manned fighter aircraft trying to penetrate A2/AD bubbles. The most cost effective solutions will be relying on adaptable professional Soldiers, Sailors, Airmen, Guardians and Marines who use adaptable doctrine and commercially adapted tools to win in innovative ways. Leaning into artificial intelligence (AI), constellations of small unmanned aerial systems (sUAS) for counter insurgency (COIN) and counter terrorism (CT) fights, and use of lower cost space access in the mid-future will enable a much more effective American defense policy.

Not only are those types of acquisitions more cost effective than trying to implement geriatric doctrine to put a Next Generation Air Dominance (NGAD) on the end of a hyper-expensive logistics chain, it's also tactically superior to do so with cheap robots and high ground than to confine yourself to tactics limited by both the weak imagination and limited physiological capabilities of squishy bags of water.

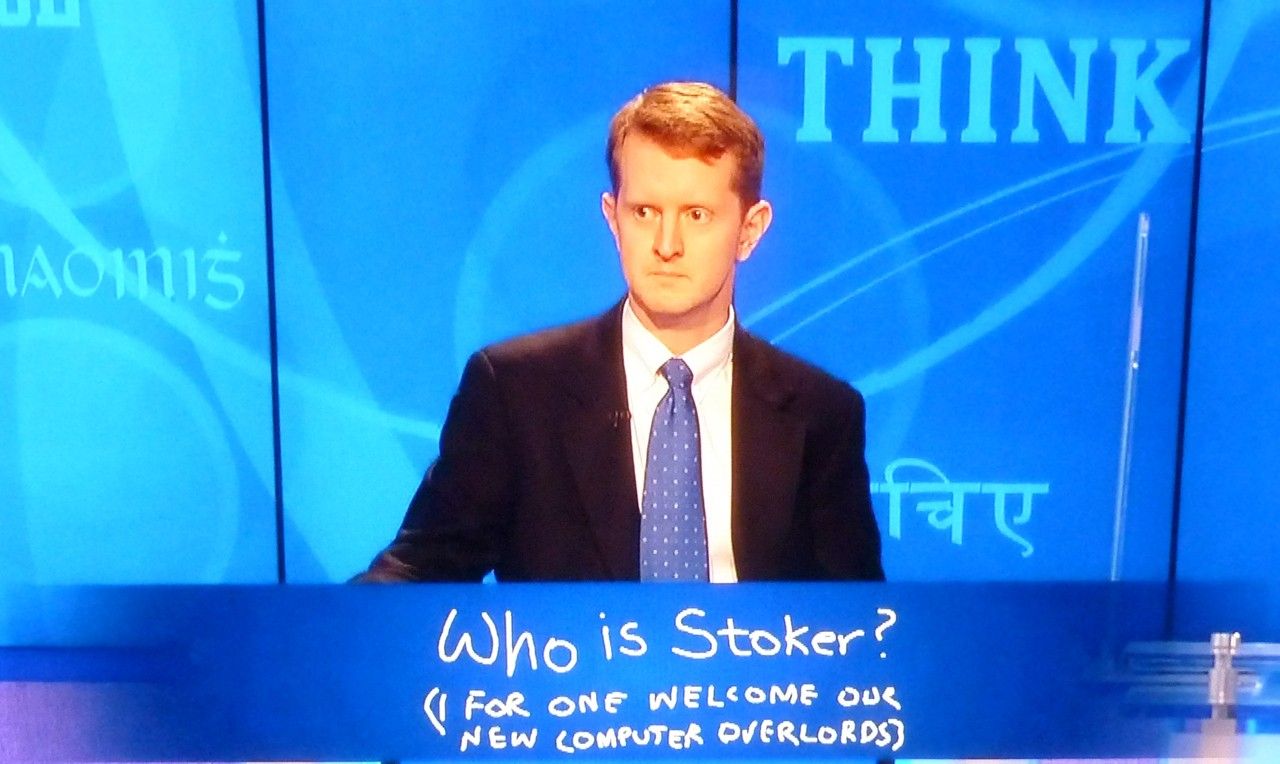

Pilots claim they can beat AI, but that illusion won't last. Kasparov believed Deep Blue was designed to defeat him in 1996, but the truth is most PCs can crush Magnus Carlsen now. The robots will eventually win. Might as well be the ones in control while we still can.

Header image courtesy of Disney.

1 BBC News. 2023. Niger coup: Junta shuts airspace citing military intervention threat. August 7.

2 Sagalyn, Dan. 2014. Airmen at odds with Air Force brass over future of beloved A-10 plane. April 8.

4 Jones, Henry. 2018. The Recent Large Reduction in Space Launch Cost. July.

5 Our World in Data. 2022. Cost of space launches in low Earth orbit.

6 Connellan, Shannon. 2023. Watch SpaceX launch 22 more Starlink satellites. August 7.